A perspective on recent industry shifts influencing ACA plan operations in states, which are yet to adopt ACA Medicaid expansion

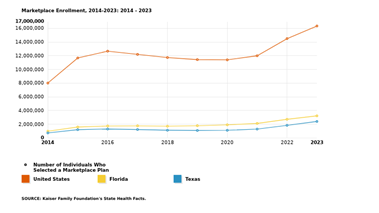

Health Exchange plans covered under ACA (Accountable Care Act) witnessed 36% enrollment growth between 2021 and 2023. This is the sharpest rise in ACA enrollment since inception.

A disproportionate share of this growth is coming from 10 states, which have yet to adopt ACA Medicaid expansion provisions. In contrast, states that adopted ACA expansion for Medicaid in time could consume the growth effects more evenly. This blog summarizes various cause and effect of operationalizing ACA plans in states that have yet to adopt ACA Medicaid expansion.

Post-pandemic effects influencing the demand surge for Health exchange plans

Extended Medicaid continuous enrollment, which was covered through Families First Coronavirus Response Act during onset of pandemic, ended on Mar 31, 2023. This added a significant number of the uninsured population, increasing the demand for the health exchange (i.e., ACA plans).

Additionally, pandemic-driven unemployment rise further fueled the demand surge. Ten states that are yet to adopt ACA Medicaid expansion provisions have a much wider band of such uninsured population. As per a KFF study, Texas and Florida have the highest percentage share of the uninsured population.

Inconsistent journey of insurers offering ACA plans, especially in states which are yet to adopt ACA-Medicaid expansion

According to a recent Mckinsey report, insurer participation continued to grow in ACA, but at a slower rate. Twenty six new insurers that entered the market in 2023 got offset by 20 insurers leaving the market, with a net increase of 2%. In 2023, the state of Texas (which has yet to adopt ACA Medicaid expansion), witnessed the re-entry of a national insurer as well as aggressive expansion by existing national insurers.

11 out of 13 insurers in Texas raised premiums for ACA plans in 2023

National insurers, and few regional insurers, could contain the premium rise under 10 percent, whereas other insurers’ premium rise was 10%–30% during OEP (Open Enrollment Period 2023–24). The high rise in healthcare costs, a sudden surge in ACA plan demand, uneven risk pooling, concentrated membership and a steep administrative loss ratio all contributed towards premium rise. This has further led to insolvency and the exit of few leading insurers from Texas.

Regulatory changes and allied economics have always influenced ACA flux since its inception

The Inflation Reduction Act enabled a continued extension of tax credits for ACA plan purchases till 2026, and includes provisions to offset the enhanced premium rise. These provisions aim to ensure that healthcare costs remain affordable for consumers, despite the rising cost of healthcare services.

In another instance, a recent ruling by a federal judge in Texas curbed the coverage of key preventive services without any cost-sharing for their enrollees. As per KFF estimates, such preventive services benefited 100 million people annually.

Efforts are underway to appeal and stay this ruling. However, if odds turn in favor of the judge’s ruling, it will surely influence preventive service utilization for ACA plan beneficiaries and long-term health outcomes, in addition to an increase in out-of-pocket expenses.

Key payer considerations

Considering the above, ACA plan insurers should engage close-monitoring controls, enable simplified operations and extend transparent reporting with state bodies to:

- Improve growth and retention through seamless member interfacing and member services

- Monitoring risk pooling continuously through population risk assessment, Administrative Loss Ratio (ALR) re-calibration and end-of-year projections

- Maximize PMPM earnings through cohesive state/federal subsidy accounting

- Ensure ACA incentive earnings through comprehensive regulatory and compliance auditing and reporting

- Enable triple-aim goals through adoption and financing of innovative care delivery models in collaboration with key provider networks

- Enhance efficiency and optimize ALR through current state assessment, process automation and technology transformation across the value chain

With the economic rebound and rise of employment, pandemic ripple effect on ACA is expected to balance over next few years. The return of more national payers into ACA would drive market consolidation in regional markets, bring down costs, offer more choices and boost long-term sustenance of ACA. Please watch this space, as it will be interesting to witness ACA trends from here!

If you would like to connect with one of Inovaare’s industry experts to discuss your ACA requirements, please contact us or call us at 1.408.850.2235