Manual management of Provider Dispute isn’t viable anymore

Payer operations leaders know this: provider disputes are where efficiency goes to die.

They start small, a misread code, a partial payment, a provider escalation that should’ve been a quick fix. But soon, the inbox fills up, SLAs slip, and a process meant to resolve friction ends up creating more of it.

Every health plan thinks they have it under control until audit season hits or a major provider threatens escalation. That’s when the real cost of “manual management” shows up, in backlog reports, compliance findings, and strained relationships that take months to rebuild.

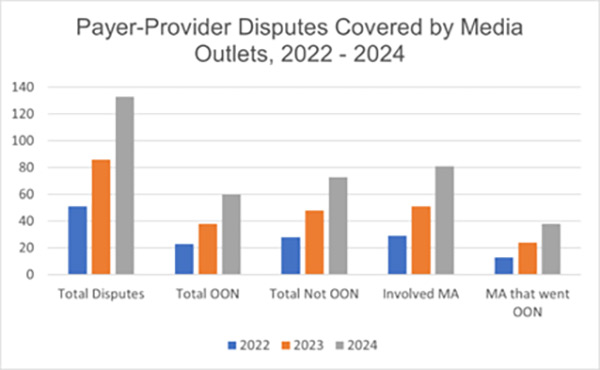

Payer-provider disputes statistics that sets the context

Increasingly, payers-providers are facing challenges in reaching agreements related to important contract terms, including reimbursement rates, utilization management, care coordination and disease management, quality improvement and performance metrics and other contractual terms that impact millions of beneficiaries. Source

| — In 2024, 133 payer-provider disputes were reported, a 54% increase compared to 2023. Source — Of the 133 disputes, 80 disputes involved MA plans. Source — 45% of the disputes failed to reach a timely agreement, resulting in disruptions in care. — About 38 MA plans failed to reach a timely agreement, impacting seniors and disabled individuals enrolled in the Medicare program. Source |

In early 2024, a federal judge refused to dismiss In re MultiPlan Health Insurance Provider Litigation, where providers alleged that MultiPlan and several insurers conspired to suppress out-of-network reimbursements. That’s not a minor grievance, that’s a dispute management failure elevated into litigation.

Again, in 2024 Blue Cross Blue Shield agreed to a $2.8 billion settlement to resolve claims by hospitals and physicians that they were systematically underpaid.

These aren’t isolated data and stories, they’re warnings.

Behind every large-scale dispute is a trail of unresolved cases, delayed reconciliations, and documentation gaps that began in spreadsheets and inboxes. What starts as operational friction can, without structure, evolve into financial and reputational risk.

From litigation headlines to payer realities

For too long, payers have treated provider dispute management as a necessary nuisance. Health plans that accepted this as inevitable, a back-office problem to be managed, not transformed are rewiring their processes because manual dispute management isn’t sustainable anymore. Given the volume, velocity, and visibility expectations manual workflows aren’t just inefficient, they’re liabilities payers can’t afford to overlook.

Automation in provider dispute management is no longer a strategic choice. It’s a structural necessity, a hedge against operational, financial, and legal fallout.

The invisible cracks inside manual provider dispute workflows

Manual provider dispute management often hides its inefficiencies in plain sight. The processes feel familiar, and each step feels manageable on its own, but together they form a maze of untraceable tasks and blind spots.

Provider Data lives everywhere, and nowhere

Evidence sits in claim systems, notes in shared folders, correspondence in email chains. When compliance asks for a full audit trail, it takes a week to stitch it all together. By then, the response is outdated and incomplete.

No real accountability for provider disputes

When multiple teams own parts of a single case, Provider Ops, Finance, Compliance, no one truly owns the outcome. SLAs are tracked reactively, often when a deadline is already breached.

Dependency that damages provider relationships

What looks like control is actually dependency. Every case depends on a person remembering, following up, or updating a tracker. When staff turnover hits or volumes spike, backlogs balloon and reflects in poor provider satisfaction.

Compliance fragility

CMS and state auditors expect a clear, traceable line from dispute receipt to resolution. Without connected systems, evidence and decisions scatter across emails and local drives. During audits, assembling a complete dispute history becomes a high-stakes scavenger hunt. Missing documentation can expose plans to compliance findings, or worse, repeat citations.

Automating Provider Dispute Management: a foundation, not a fix

When most payers hear “automation,” they think of convenience. But in provider dispute management, automation isn’t just about saving time, it’s about creating stability and predictability in a process that directly affects revenue, compliance, and provider trust.

Automation standardizes what used to be improvised. Disputes flow through defined stages, intake, validation, assignment, resolution, closure, each tracked, timestamped, and traceable.

However, the bigger shift, perhaps, is cultural. The highest ROI that automation brings is visibility, a single pane of truth that lets compliance, operations, and leadership see the same reality in real time.

Automation isn’t a patch for broken processes.

It’s the new operating system for how payers manage complexity, not to replace people, but to let them focus on judgment, negotiation, and improvement instead of manual administration.

AI Agents powering provider dispute management

While automation brings order, the next frontier is intelligence. The real shift begins when systems stop waiting for human input to understand what’s happening. Many payers are now experimenting with AI Agents that are not simple chatbots or rule engines. They’re trained assistants that understand healthcare data, context, and compliance logic. They don’t just execute steps; they interpret, summarize, and recommend, using every past case as a learning input.

AI Agent for dispute intake

Instead of analysts reading provider letters line by line, AI Agents extract key information, provider ID, claim number, dispute reason, and auto-populate case forms. Intake that once took hours now happens in seconds.

Evidence discovery

AI Agents can pull relevant claim files, authorization data, and prior correspondence from connected systems, organizing them into audit-ready packets. Analysts start with all the facts instead of searching for them.

Decision support

Based on past resolutions, AI Agents suggest the most likely outcomes or recommend next steps. They learn from every closed case, continuously improving consistency and speed.

Provider Disputes: From cost center to strategic function

When dispute management becomes predictable, it stops being a cost center.

With automation and AI, health plans gain something harder to quantify but more valuable than efficiency, control.

- Control over turnaround time, reducing average resolution cycles from weeks to days

- Control over documentation quality, ensuring every case is audit-ready by design

- Control over compliance visibility, replacing uncertainty with real-time dashboards

- Control over provider experience, restoring trust through consistency and transparency

That control creates compounding returns across the enterprise. Faster resolutions reduce escalation and legal exposure. Fewer errors mean cleaner audits and fewer findings. Cleaner audits mean less rework, fewer CAPs, and reduced administrative drag.

The financial impact adds up quickly:

- ~30–40% savings in administrative labor

- Up to 70% faster resolution times

- Higher provider satisfaction and network retention

- Lower penalty and interest payouts from SLA breaches

Over time, dispute management evolves from a reactive obligation into a proactive governance function, one that protects both margins and relationships.

This is how payer organizations move forward: not by adding more systems, but by removing the friction that keeps them from seeing, acting, and improving as one connected operation.

The quiet transformation already underway

In a world where compliance expectations tighten and provider relationships define brand reputation, doing nothing is the most expensive choice of all.

Automation isn’t about ripping existing systems or replacing people, it’s about restoring purpose.It turns dispute management from a reactive chore into a system that learns, adapts, and improves with every case.

Across the industry, forward-thinking payers are reengineering dispute management as part of a larger compliance modernization effort, and a strategic engine for operational credibility.

They’re adopting platforms where automation, AI Agents, and analytics work in sync, not as separate tools but as one intelligent ecosystem, because the future isn’t just about managing disputes better, it’s about preventing them through better data, faster feedback, and smarter systems.

That’s the vision behind Inovaare’s Health Cloud Platform, unifying compliance, operations, and analytics so payers can manage provider disputes with accuracy, speed, and confidence. Built for the realities of healthcare, it gives teams the control and visibility they’ve always needed but never had.

Explore how Inovaare helps payers turn dispute management into a driver of trust and performance ›