Compliance gaps are costing more than just fines

CMS Program Audits are not just a regulatory formality, they are high-stakes events that expose persistent blind spots across Medicare Advantage and Part D sponsors. In 2024, CMS conducted 39 total program audits of 36 parent organizations, 19 of which were routine (i.e., full-scope program audits) and the remaining 20 were focused audits (i.e., limited program areas were audited). This covered 494 MA contracts covering 87.6% of all beneficiaries enrolled in an MA plan.

In 2024, MOEG’s Division of Compliance Enforcement (DCE) imposed 14 Civil monetary penalties (CMP) actions on sponsors totalling over $292,432,000. There were 18 specific violations (10 for Inappropriate cost sharing for Part C services/Part D medications, 6 for Inappropriate denials/delays of Part D medications, and 2 for Misclassification of Part D coverage requests) cited in the 14 CMPs.

What do these numbers reveal?

Not just non-compliance, but deeper systemic issues. Most health plans don’t miss the mark because they’re negligent. They miss it because their operations are disconnected, documentation is scattered, and compliance efforts are reactive rather than data-driven.

The result? Gaps slip through unnoticed until CMS flags them, by then, it’s too late.

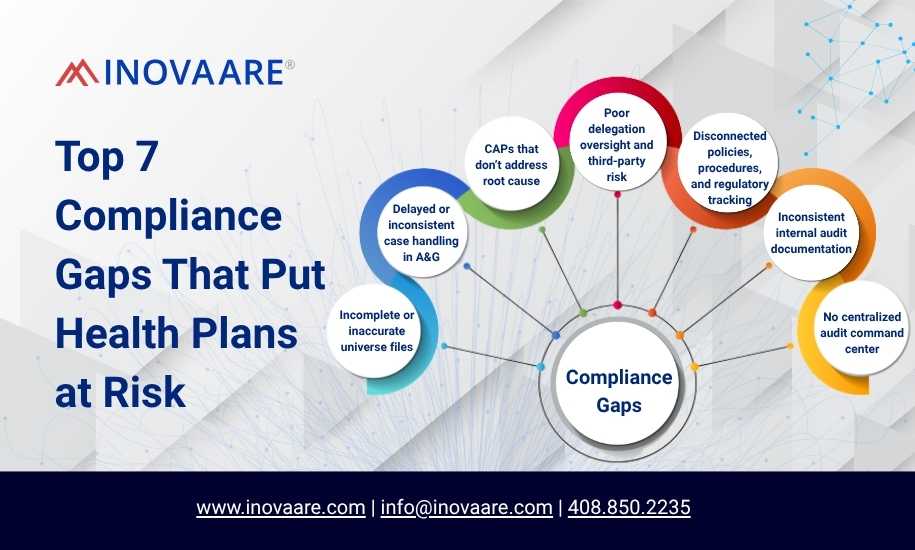

If you’re part of a compliance, audit, or operations team at a health plan, here are the 7 most common gaps that can derail your CMS audit, and how to close them.

Top 7 Compliance Gaps

1. Incomplete or inaccurate universe files

Why it matters: Universe files are the first thing CMS reviews. One formatting error can flag your entire submission. In 2022–2023, the most common Part C and D audit failures involved invalid universes or missing required fields.

Common issues:

- Missing required data fields

- Inconsistent formatting across departments

- Manual, last-minute file compilation

How you can fix it: Invest in automated universe scrubbers that validate format, completeness, and logic against CMS standards before submission.

2. Delayed or inconsistent case handling in A&G

Why it matters: CMS expects timeliness and transparency in Appeals & Grievances (A&G) processes. Many plans still use semi-manual intake and lack system-driven case routing.

CMS 2023 audit data revealed:

- 21% of audited plans had untimely case resolutions

- 15% failed to notify members within mandated timeframes

How you can fix it: Use connected A&G platforms with automated case tracking, escalation workflows, and real-time documentation.

3. CAPs that don’t address root cause

Why it matters: CMS isn’t looking for quick fixes, they’re looking for systemic corrections. CAPs that merely patch over the issue will not satisfy audit reviewers.

Common red flags:

- Vague remediation timelines

- No proof of sustainable process change

- Lack of ownership or accountability mapping

How you can fix it: Adopt a centralized CAP management system that ties findings to structured action items, ownership, and measurable milestones.

4. Poor delegation oversight and third-party risk

Why it matters: Plans are responsible for vendor and FDR compliance, but most only audit reactively or too narrowly.

GAO and OIG reports continue to cite that “Lack of documented oversight practices, incomplete delegation agreements, and inconsistent performance audits” as top findings.

How you can fix it: Use integrated Delegation Oversight tools that monitor vendor performance, documentation, and CMS-readiness all in one place.

5. Disconnected policies, procedures, and regulatory tracking

Why it matters: When your policy library doesn’t align with CMS updates, audit risk increases. This is especially true after regulatory changes like CMS-0057-F (Prior Authorization Final Rule).

In 2023, plans struggled to:

- Show policy updates after rule changes

- Demonstrate training and dissemination logs

- Track P&P version history and approvals

How you can fix it: Deploy AI-powered policy governance tools that link regulations to internal policies, automate tagging, and document policy lifecycle.

6. Inconsistent internal audit documentation

Why it matters: Health plans that perform internal audits often lack consistent templates, findings summaries, or CAP traceability.

What CMS looks for:

- Internal audit frequency and scope

- Issue categorization and recurrence

- CAP linkage with documented remediation

How you can fix it: Use audit platforms with AI-generated findings, audit lifecycle management, and role-based tracking dashboards.

7. No centralized audit command center

Why it matters: CMS doesn’t wait. When audits are announced, plans must respond in days. If your systems, people, and files are scattered, your risk multiplies.

A 2023 survey by HealthTech Insights found that only 1 in 3 Medicare Advantage plans had a real-time audit response dashboard.

How you can fix it: Build a command center approach, centralized dashboards, CMS logic alerts, documentation repositories, and AI bots for audit prep.

What you can do next

- Run a Data Readiness self-assessment

- Identify universe file vulnerabilities

- Review CAPs from the last audit cycle

- Map delegation audit coverage

- Consider platform solutions that bring all these together

Audit readiness is a data issue, not just a compliance task

CMS audits will only get stricter. The solution isn’t more people or more training. It’s smarter systems that connect workflows, enforce compliance logic, and reduce fire drills.

Your first step? Fix the seven most common gaps, before CMS points them out for you.

Or, let the experts do it for you. www.inovaare.com

Amy Cornett, VP of Compliance

Connect on LinkedIn